You are now in danger of being culled from the vendor stack, and you had better start asking the right questions or you are going to cost you employer lots of money.

Virtually every business on the planet has some means by which to rank-order its suppliers-vendors in terms of strategic importance or level of priority. Businesses now pay increasing attention to what is often referred to as their ‘vendor stack’ and the myriad of costs associated with managing vast numbers of vendors.

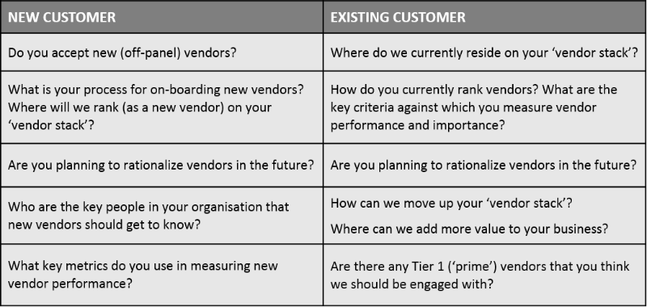

Example of a ‘vendor stack’.

In 2016, the global market for technology products and services, and the various sub-markets, has now reached a new level of market maturity meaning that most market segments are characterised by huge amounts of vendors competing for the same customer. The now common customer edict of doing “more business with less vendors”, coupled with the modern approach to the ‘vendor stack’’ are major game changers for vendor sales people, and yet very few sales organisation actually understand how these issues impact their conversion rates. Sadly, most of today’s sales people have absolutely no idea about where they rank on their customers ‘vendor stack’, and this is a disaster waiting to happen. Let me explain why.

Increased competition has gradually led to an oversupply of technology vendors with many businesses now recognising that dealing with vast numbers of vendors (in some cases single-product vendors) makes no sense: commercially, strategically or operationally. As a result, many businesses are now undertaking ‘vendor rationalization’. That is, businesses are seeking to ‘cull’ any existing vendors that may be seen as ‘non-essential’. In fact, in many western developed economies such as Australia, many enterprise level businesses (large corporations) are now mandating to ‘block’ engagement with any ‘new’ or what is often referred to as ‘off-panel’ vendors – insisting on finding a ‘substitute’ product from an existing (pre-approved) vendor, and this is now beginning to have a significant impact on the way in which IT buyers engage with vendors – especially ‘off-panel’ vendors. Organisations such as National Australia Bank, Westpac Bank, Telstra, Suncorp and Qantas have all openly stated a genuine move towards reducing the vast numbers of vendors that they deal with simply to run their operations.

My research into this subject, along with 27 years of sales experience tells me that whilst understanding how your customers view you as a supplier/vendor is a common sense thing to do, today’s sales people are so caught up in the on-going pressure of short-term revenue attainment that they forget to ask these critically important questions.

If you have any doubt about the seriousness of this issue, then I challenge you to simply ask your sales people where your company ranks on the ‘vendor stack’ within each of the accounts that they manage?? I’m certain that I know what response you will receive.

So what? Within the traditional B2B sales model, the qualifying stages of each and every sale always requires significant amounts of time and, in some cases, large amounts of company resource. Of course, there would be little point in going through the entire qualifying phase: developing trust and rapport, gathering and analysing requirements, designing solutions, only to find that your customer is not permitted to accept new, or ‘off panel’, vendors. Wouldn’t it be preferable to learn that right up front? What’s the point of finding out that you have just lost a customer (through being 'culled' from the vendor stack) after the decision has already been made? Obviously, it would be preferable to identify where you stand on the ‘vendor stack’ before you get ‘culled’, allowing corrective action if required.

It is much more important to understand each individual customers ‘vendor stack’ than any other aspect of sales qualifying – regardless of whether or not the customer is a prospective new customer or existing. My point here is simply that qualifying, relationship building and searching for pain points is a huge waste of time and company resource until the sales person has been able to ascertain some of the fundamentals surrounding each customer’s buying journey and their respective approach to the 'vendor stack’. Vendor sales people who fail to identify what is now a common customer policy for “blocking” new vendors will risk spending months working on what they may believe is a revenue-producing opportunity only to find that their exciting forecasted opportunity falls over at the final hurdle. This can cripple smaller vendors and, sadly, I have seen this happen.

Upward mobility (within the ‘vendor stack’) is not only difficult, but also uncommon. Regardless, vendors must therefore work hard to find any means by which they can move up the ‘vendor stack’ in order to protect these existing customer relationships. If you are a small, single product vendor (Tier 3 or higher) then it makes good sense to find a strong ally within the customer account….creating a strategic alliance with an existing Tier 1 or ‘prime’ vendor is a smart thing to do, and I have seen this strategy work for smaller vendors.

Vendors will increasingly have to learn to invest in protecting their position within existing customers as a priority over the commonly sought after “net new” customer growth. The old days of what I call “hit & run” selling are fading into a distant memory, and vendor sales people must now ensure that they now ask the following critical questions right up front in the sales process:

To be successful in the modern era of high tech sales the vendor sale person must now:

- Identify where your business currently resides on the ‘vendor stack’ with each and every existing customer. If it’s a new target customer that you have never sold to before, then it’s critical to establish whether or not the new customer will actually accept new (‘off-panel’) vendors?

- Distinguish any means by which you can move up the ‘vendor stack’ in order to protect your position within the account.

- Highlight any areas of the customer technology eco-system where your product is integral to your customer’s business operations. Leverage this position and ensure that the customer’s vendor management and procurement personnel are aware of your position and the value-add that you bring to their business. Work hard to ensure end-user productivity.

- Clarify the overall vendor landscape with each account. Focus on ascertaining whom the Tier 1 (‘prime’) vendors are within the customer’s ‘vendor stack’. Identify any personal connections with Tier 1 (‘prime’) vendors that may be able to be leveraged.

- Commence informal relationship development with existing Tier 1 (‘prime’) vendors for each key account as part of a defensive (retention) strategy. If the Tier 1 (‘prime’) vendors don’t know you, they can’t help you.